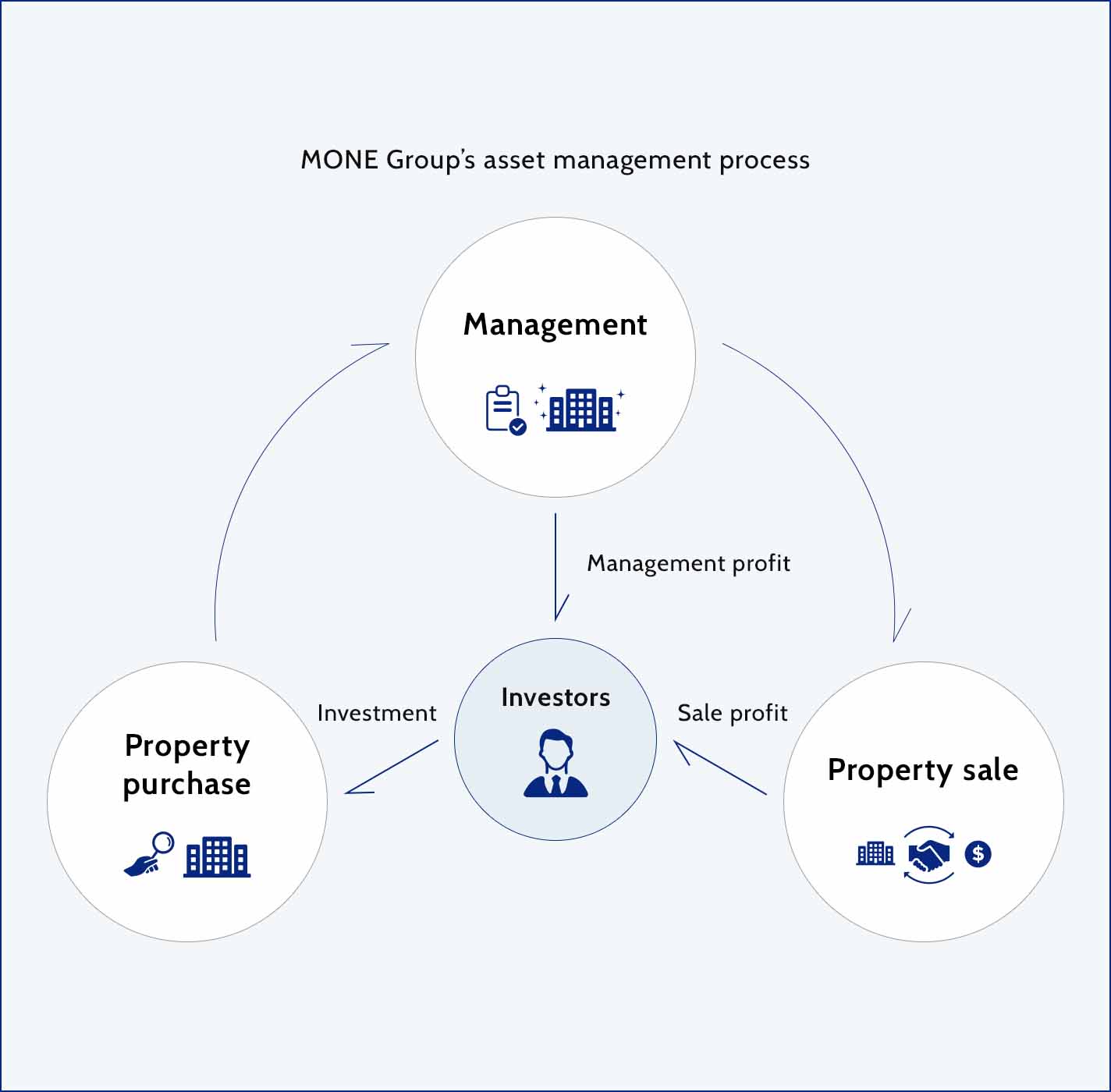

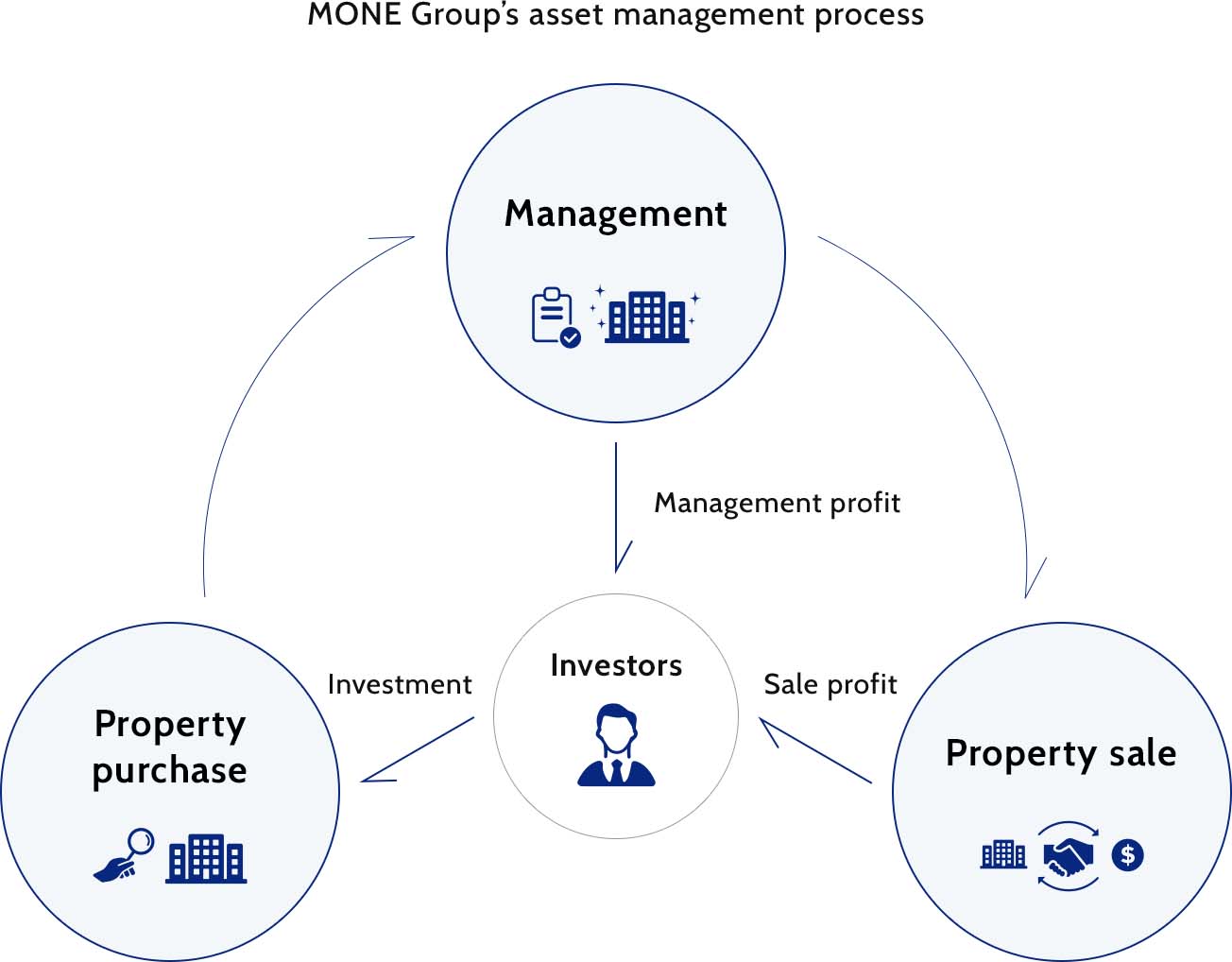

Business model

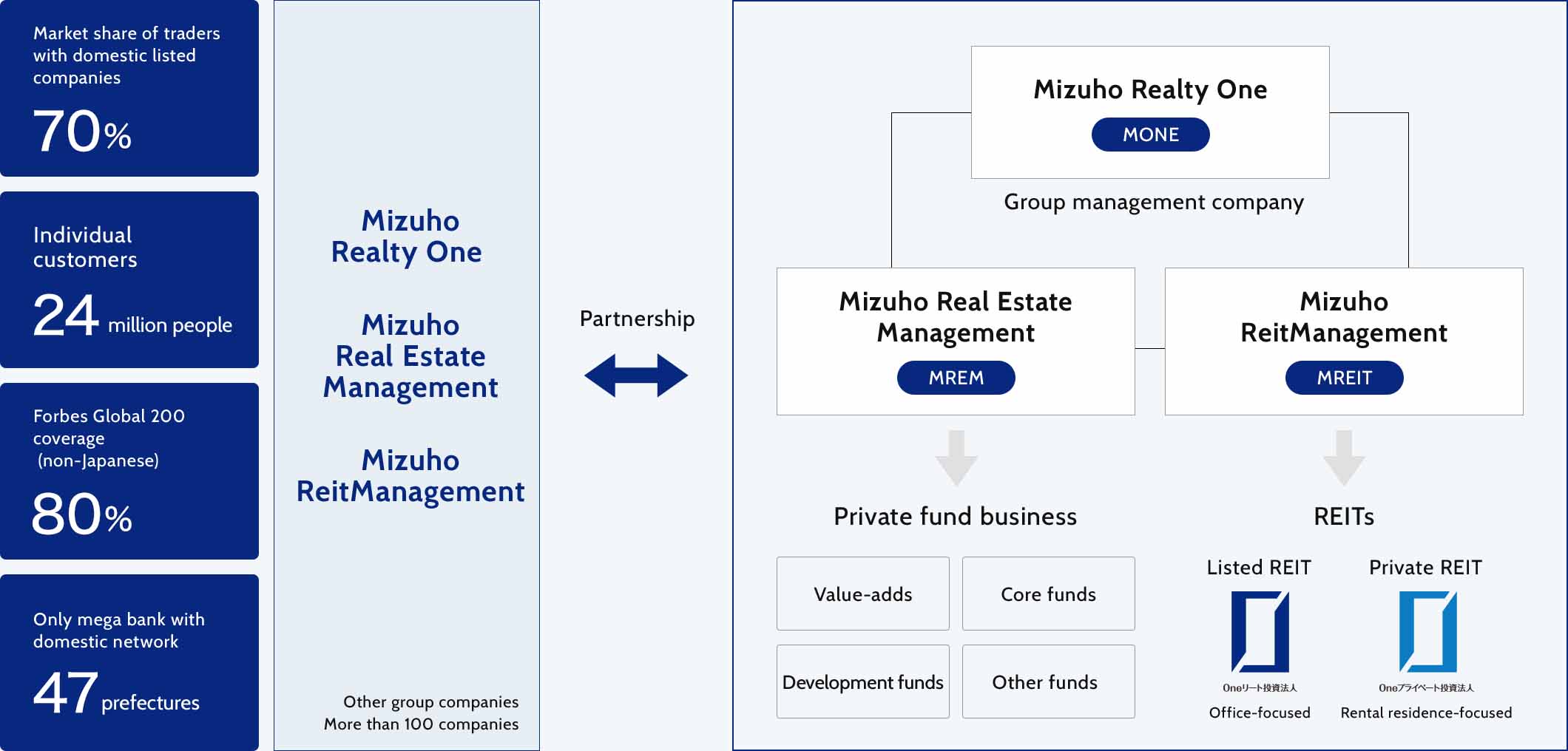

Mizuho Financial Group’s only management company specializing in real estate. A professional of real estate management developing business areas such as private funds, private REITs and listed REITs.

- Private Fund Business

- Management Consulting Business(CRE Strategy)

- Private REIT Business

- Listed REIT Business

Strength

We support customers with the unique strengths of Mizuho Realty One.

group customer base is possible

generating added value

- Facility management

- A unit supporting the maintenance and improvement of real estate value based on specialized knowledge and abundant experience in construction and facilities.

Possesses data on track records of construction work exceeding 40,000 cases, which is the number accumulated since establishment, and plans and promotes the creation of added value through resolution of issues from tangible aspects at the time of property acquisition as well as management and development.

Renovation casebook PDFHas a track record in various renovation work extracting the value of real estate such as “conversion,” “renewal” and “ESG renovation.”

Development casebook PDFAims to develop real estate of which use and quality are unique to the location by placing importance on regional characteristics, and has a track record in development of real estate with various uses.