Overall Internal Control System MANAGEMENT

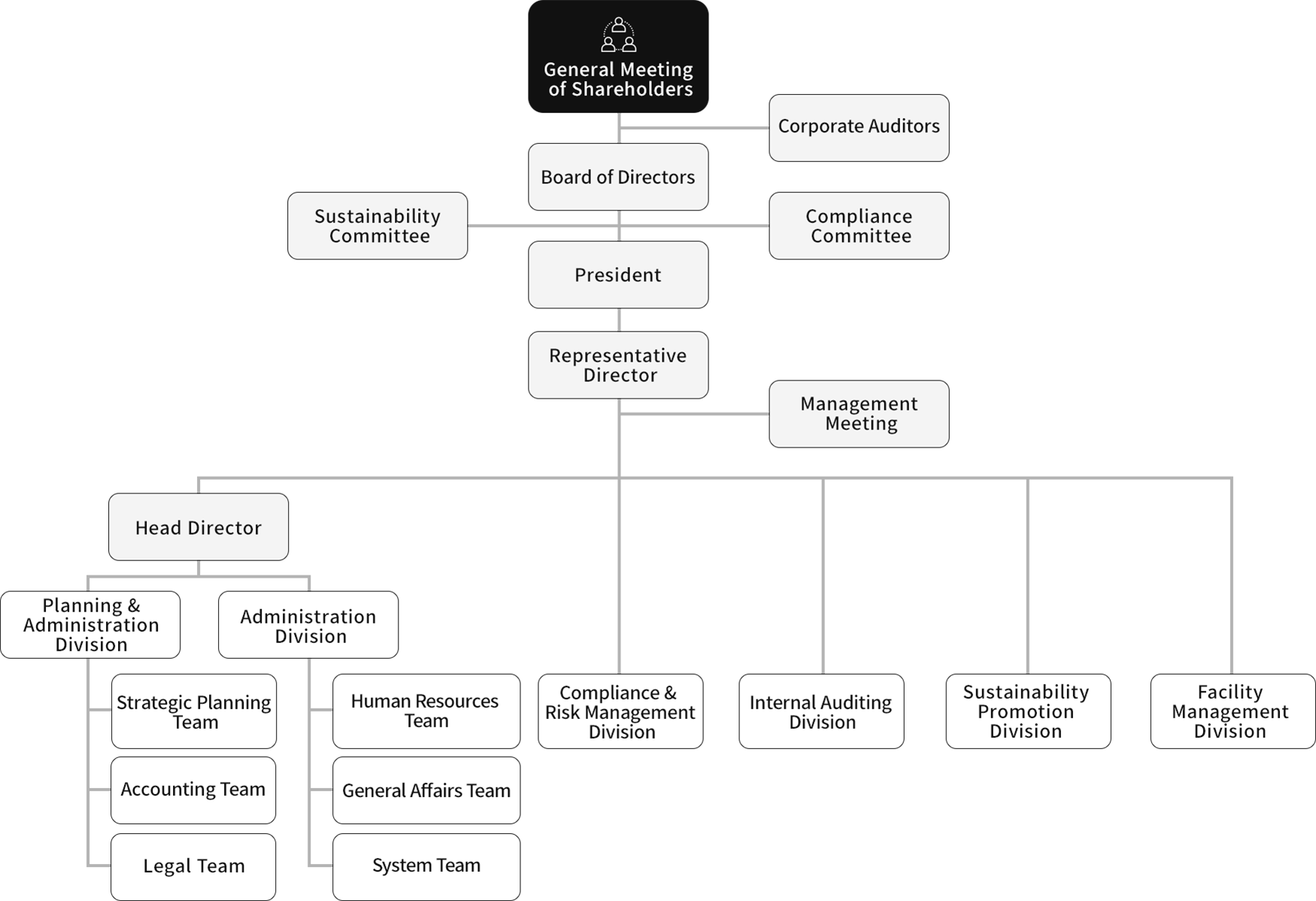

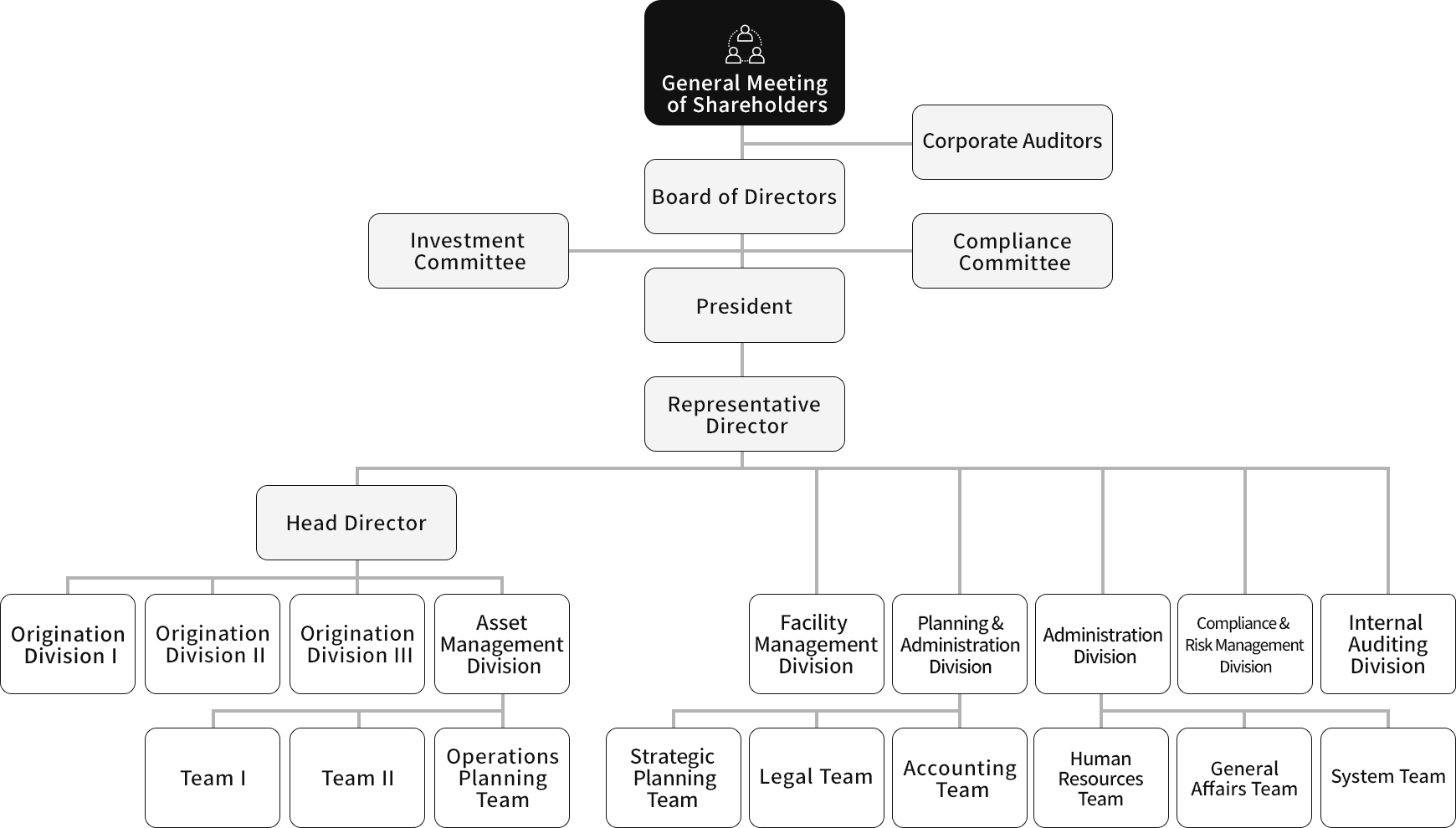

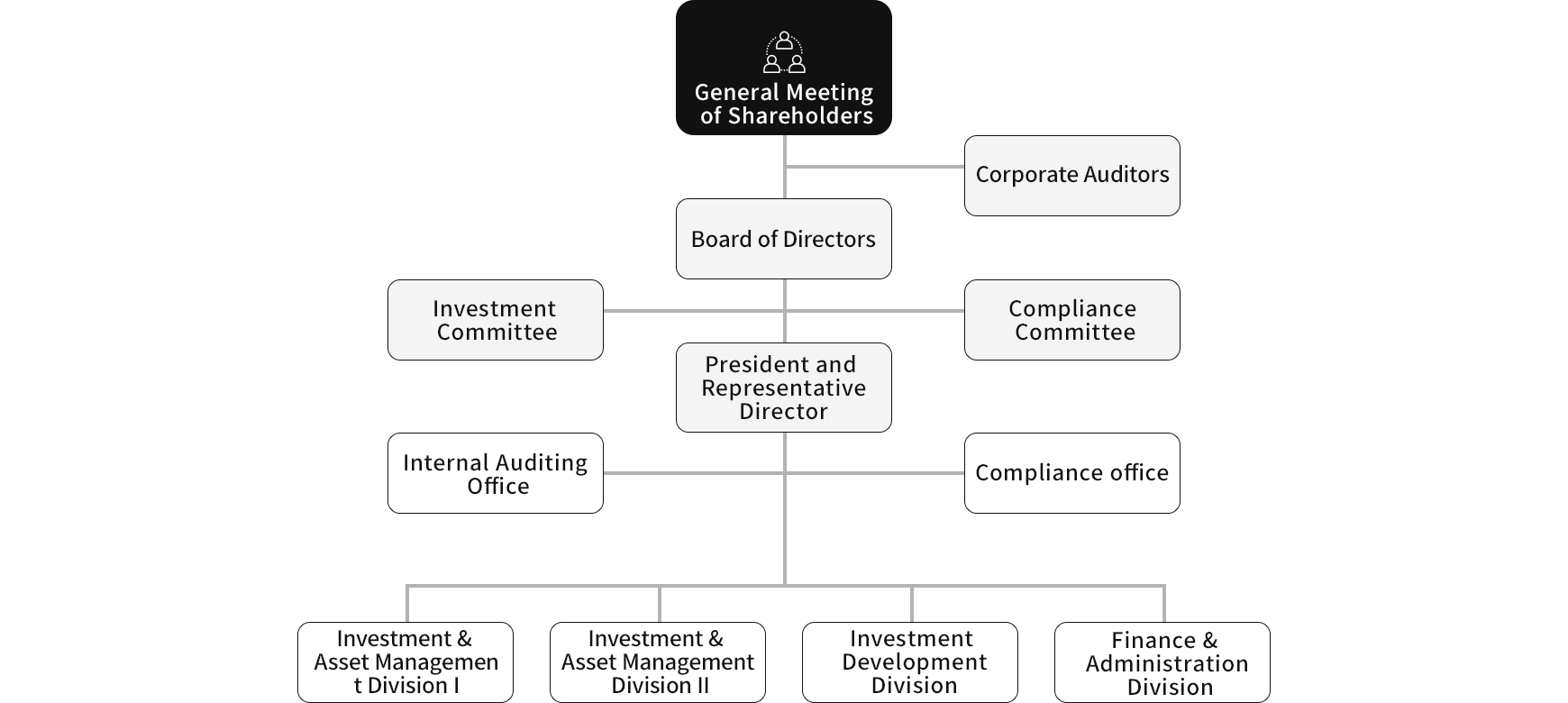

Governance System

At each company in Mizuho Realty One Group, the Board of Directors makes decisions on matters stipulated by laws and regulations relating to the appointment of representative directors, etc. and key management-related issues. While execution of operations is optimized and expedited by delegating authority to directors as needed, key issues are resolved by the Board of Directors, with appropriate decisions made through open discussion and mutual supervision by the directors and auditors. The auditors conduct accounting and operational audits and, if necessary, supervise execution of the company’s operations in collaboration with the Internal Audit Division and related responsible departments. An officer is also appointed to manage compliance-related matters, and a Compliance Committee is established as a collegial body to deliberate on key compliance-related matters.

Furthermore, recognizing the importance of asset management business as the act of managing investors’ funds, the asset management companies Mizuho Real Estate Management (MREM) and Mizuho REIT Management (MREIT) have established Investment Committees as bodies that deliberate matters relating to asset management and make resolutions regarding them.

Overview and Composition of Board of Directors

The Board of Directors at each company in Mizuho Realty One Group acts as a meeting body that decides basic policies related to each company’s management and, by means of resolutions, matters stipulated by the laws and regulations and the articles of incorporation, as well as all key matters relating to execution of the applicable company’s operations. The board meets at least once a month (at least once every three months in the case of MREIT).

The Board of Directors implements effective corporate governance, through which it aims to take responsibility for pursuing the sustainable growth of the relevant company in Mizuho Realty One Group and maximizing its long-term corporate value. To fulfill this responsibility, the board performs supervisory functions with respect to management and ensures the fairness and transparency of management, as well as plays a role in optimal decision-making for the company through important decisions about the execution of operations.

Overview of Compliance Committee

A Compliance Committee has been established as a body to deliberate key compliance-related issues, with the aim of ensuring compliance. It consists of the members stipulated in the Compliance Committee Regulations (of whom one is an external specialist member). In addition to meeting at least once every three months (at least once a month in the case of MREIT), it holds extraordinary meetings as required. Furthermore, at the asset management companies MREM and MREIT, the committee deliberates matters concerning transactions with interested parties.

Overview of Investment Committee

In the execution of MREM and MREIT’s asset management business, the Investment Committee acts as a body to discuss and make resolutions about asset management. It consists of members who include a third party with specialized knowledge (external specialist member) and the head of the Compliance and Risk Management Division (head of the Compliance Office in the case of MREIT). It holds meetings at least once a month in principle, and holds extraordinary meetings as needed.

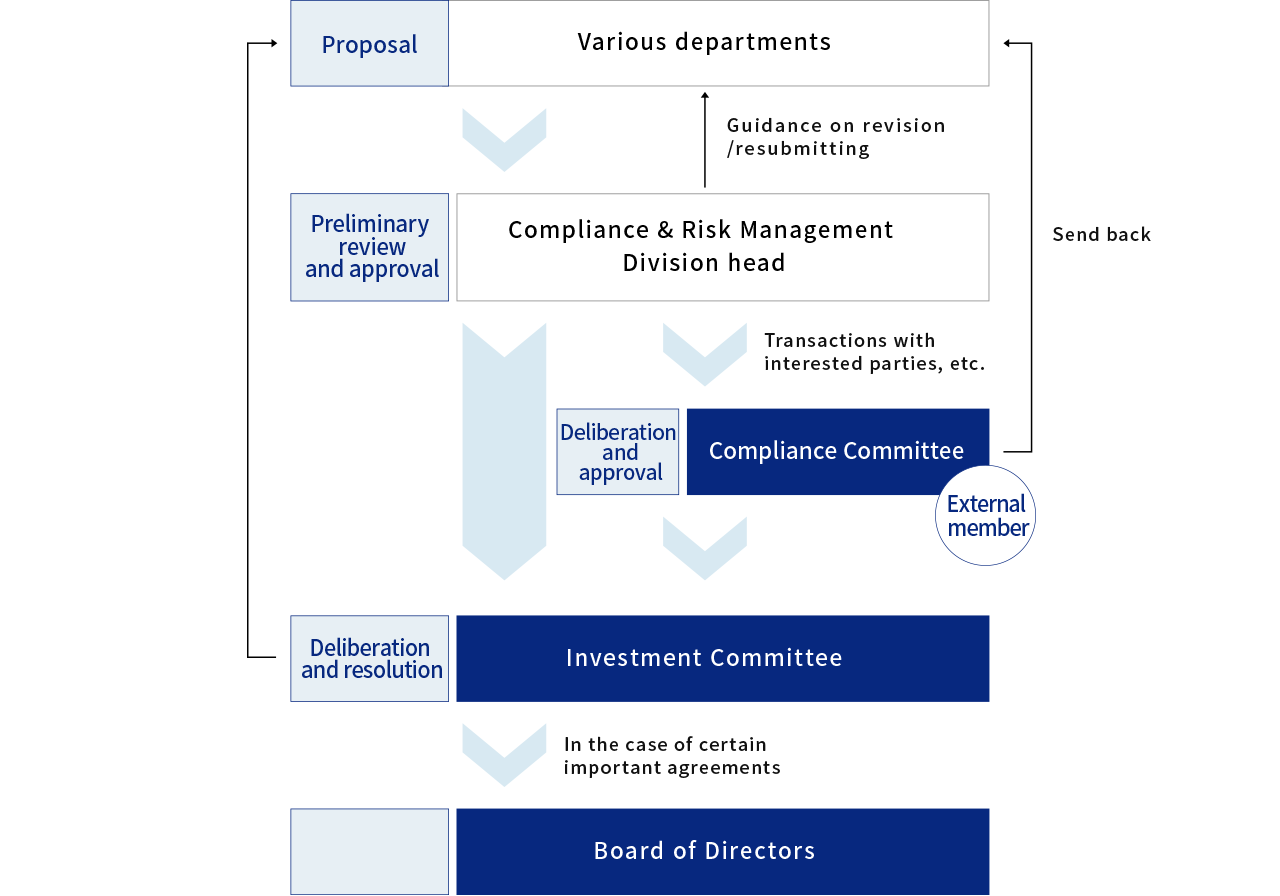

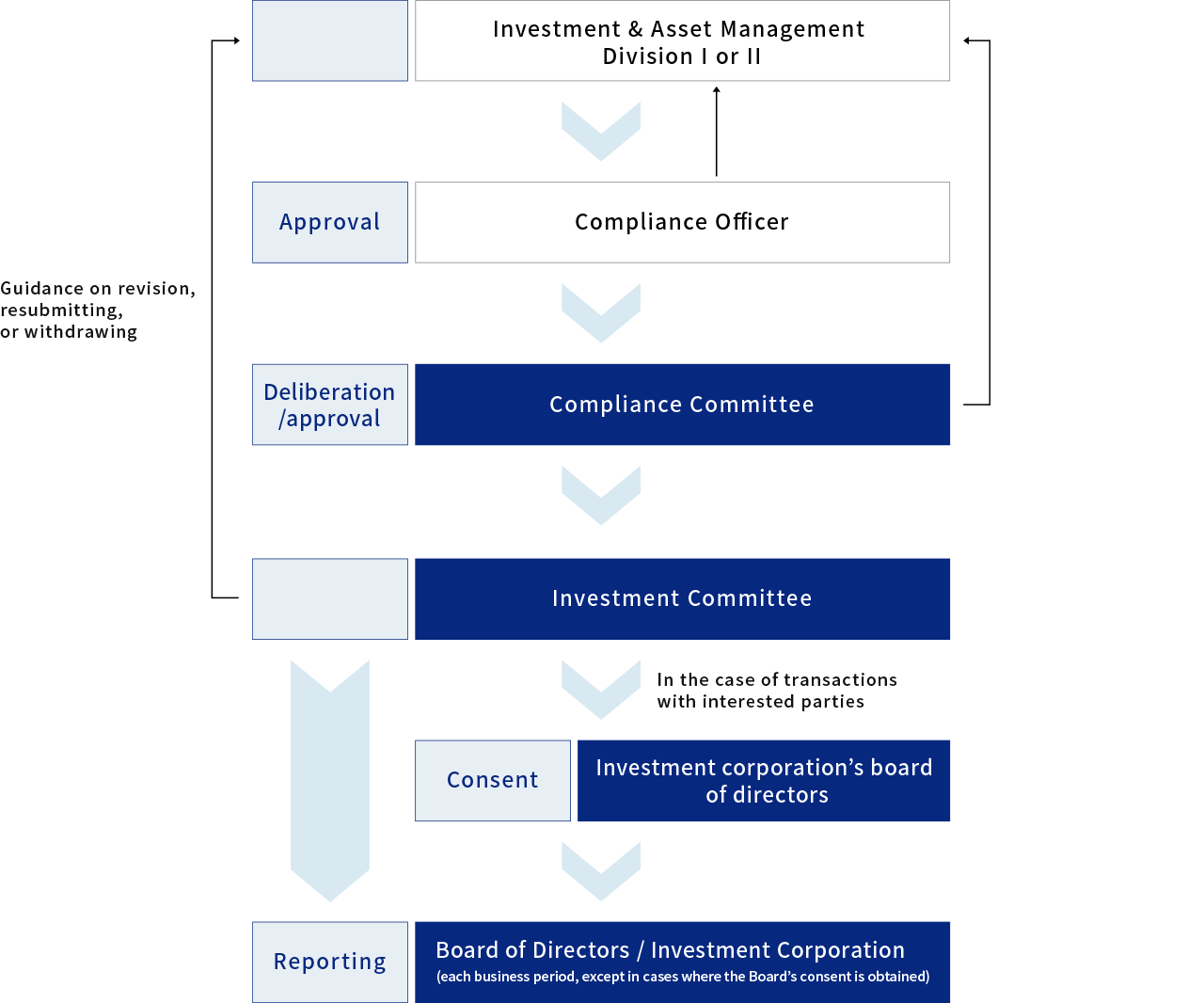

Investment Management-Related Decision-Making Process

At MREM and MREIT, the mechanism for investment management-related decision-making involves deliberation and decisions by the Investment Committee following discussion and proposal by the relevant department and preliminary validation by the Compliance Division/Office. If the proposal includes transactions with an interested party, it requires deliberation and approval by the Compliance Committee prior to deliberation by the Investment Committee. In addition, at MREIT, proposals are resolved by the board of directors of the investment corporation whose assets it manages.

Compliance System

Compliance Management System

At Mizuho Realty One, Mizuho Real Estate Management (MREM), and Mizuho REIT Management (MREIT), each company has established a Basic Compliance Policy covering fundamental matters for implementing rigorous compliance, based on Mizuho Financial Group’s Three Compliance Principles.

- Recognizing that insufficient compliance could undermine our management foundation, we view rigorous compliance as a fundamental principle of management.

- As a prominent Japanese player on global financial and capital markets, we pursue a world-class compliance approach.

- Through rigorous compliance, we will receive highly favorable assessments from shareholders and markets and earn the trust of society in general.

Each company in Mizuho Realty One Group views rigorous compliance as a fundamental principle of management and has established the following system to ensure the appropriateness and soundness of operations.

- The Board of Directors, President & CEO, Compliance Committee, Compliance and Risk Management Division head (Compliance Office head in the case of MREIT), and Compliance Officers (various department and office heads) make decisions about various compliance-related matters and manage the status of compliance implementation in their respective powers and responsibilities.

- The Board of Directors makes resolutions on key compliance-related matters.

- The Compliance Committee consists of members who include an external specialist, conducts deliberations and makes resolutions on compliance-related matters, and receives reports on such matters.

- The Compliance and Risk Management Division head (Compliance Office head in the case of MREIT) supervises planning, drafting, and promotion relating to compliance as a whole and reports to the Board of Directors about the status of compliance implementation and on compliance-related matters for resolution and key matters to be reported by the Compliance Committee.

- Various department and office heads serve as the Compliance Officer for their department or office and implement rigorous compliance within their department or office.

Compliance Activities

Each company in Mizuho Realty One Group has adopted the Mizuho Code of Conduct indicating concrete standards for ethical behavior, and each officer and employee is made fully aware of it. Each company has also prepared a compliance manual that explains the laws and regulations we must follow when carrying out our business and the compliance activities to be implemented in an easy-to-understand manner.

In addition to being checked by various departments and offices, the status of compliance implementation is monitored by the Compliance and Risk Management Division (Compliance Office in the case of MREIT). Furthermore, with regard to concrete plans for the purpose of compliance-related system development, training, checks, etc., each company establishes a compliance program for each fiscal year and follows up on its implementation status every six months.

Initiatives Against Anti-Social Forces

Mizuho Realty One Group has established a Basic Policy on Anti-Social Forces which specifies that it will sever any ties with anti-social forces that pose a threat to the order and safety of civil society and ensure the soundness and safety of financial infrastructure functions with future social changes in mind, and it pursues management based on this policy and various related regulations.

Anti-Money-Laundering Initiatives, Etc.

With financial crimes becoming more diverse and sophisticated and terrorism continuing to occur in locations around the world, countermeasures for money-laundering and terrorism financing (“money-laundering countermeasures”) are becoming more important, and strengthening financial institutions’ money-laundering countermeasures has become an issue. In carrying out its business activities, Mizuho Realty One Group is developing an approach that complies with laws and regulations and continuously pursues the strengthening of its money-laundering countermeasures.

Initiatives to Prevent Bribery and Corruption

Each Mizuho Realty One Group company has stipulated Detailed Procedures Concerning the Provision and Receipt of Entertainment/Gifts for the purpose of ensuring the appropriateness of entertainment and gifts, including preventing collusion with customers through expenses being paid to provide entertainment or gifts to external parties, such as customers, or employees or officers of the group companies receiving entertainment and gifts at the expense of external parties, such as customers. Furthermore, the companies have stipulated Operational Guidelines for Dealing with Public Officials, etc., which provide specific operational guidelines for complying with the code of conduct and specific guidelines relating to the legal granting of favors to public officials, equivalent persons, etc., and strive to implement thorough compliance by following these regulations in an appropriate manner.

Mizuho’s Whistleblowing System (Compliance Hotline)

Each Mizuho Realty One Group company has developed a whistleblowing system and strives to improve its effectiveness, such as by establishing group-wide external reporting channels that are available 24 hours a day, 365 days a year, in addition to the internal reporting channels, and by accepting anonymous inquiries and reports. Officers and employees are notified about these through posts on the company intranet. When handling inquiries and reports, it is our policy to exercise the utmost care to protect the confidentiality of whistleblowers, such as imposing a duty of confidentiality on those who receive reports (those responsible for handling whistleblowing), and take thorough steps to ensure that those who make inquiries or reports are not treated detrimentally from an HR perspective or any other way, with strict measures including disciplinary action taken against violators.

Risk Management System

Overview of Risk Management System

Mizuho Realty One (MONE), Mizuho Real Estate Management (MREM), and Mizuho REIT Management (MREIT) each views risk management as a priority management issue and have established risk management regulations.

In the risk management regulations, “risk” refers to potential losses that could occur in the future or the uncertainty of expected revenue or achieving targets*, which will affect the company’s management, execution of operations, and, in the case of MREM and MREIT, assets managed on behalf of clients, either directly or indirectly. The various types of risk to be managed and management policy are stipulated for each company (MONE, MREM, MREIT), which implements a series of risk management processes including implementing and validating activities for the purpose of identifying, analyzing/assessing, monitoring, and reducing risks.

Annual BCM Plan

In accordance with the Basic Policy for Business Continuity Management (BCM) of its parent company Mizuho Trust & Banking, MONE has established a Basic Policy for Business Continuity Management (BCM) that serves as the basic policy for Mizuho Realty One Group companies when dealing with emergency situations and implementing BCM.

During normal times, each Mizuho Realty One Group company, recognizing the risk that emergency situations may occur, develops appropriate and effective measures, a BCM framework, and an approach to handling emergency situations for the purpose of taking steps such as rapid risk reduction measures in the event that an emergency situation does occur and strives to make these known throughout the organization.